🧑🏻💻Lessons from Digital Transformation in Financial Services

and 3 actionable steps for success.

Hello Digital X’er!

I’m a big fan of knowing random facts. Like that the term ‘replicants’ is never used in Philip K. Dick’s novel: “Do Androids Dream of Electric Sheep?” the cult classic: Blade Runner is based on. 🤖

So channelling my obsession with random facts…here’s today’s question for you:

When was the first robot created?

You’ll find the answer at the end of today’s newsletter…🚀

Reminder…today’s microlesson is eligible for a free digital learning badge from microlearning platform: Skillsvarsity. More details at the end of the microlesson.

MICROLESSON #1:

Lessons from Digital Transformation in Financial Services and 3 Actionable Steps for Success

Digital transformation in financial services is difficult. Some would say elusive. In reality though, it doesn’t even matter what industry you’re in. Only 30% of digital transformation are really successful, and only 50% of those considered to be successful actually deliver any value.

When it comes to financial services, digital transformation can often mean unpacking the 20+ years legacy of technology and processes, and effectively re-imagining how this should work in a customer centric digital world.

Finance executives are naturally nervous when you mention digital transformation. Much of the World’s financial services legacy technology is programmed in languages such as COBOL and FORTRAN, which are over 60 years old, using mainframe systems architectures, that often involve tens of millions of lines of code.

The collective knowledge of a bank usually involves decades worth of accumulated business rules and processes embedded into computers. To say that financial services companies are fragile is an understatement.

Pulling that legacy apart, re-imagining and re-engineering, is a minefield that often wears out even the most enthusiastic of digital transformations. But when it’s done right, it can mean the difference between a Return on Investment (ROI) of 4% (which is below the cost of equity) vs ROIs of 20% and greater in financial services.

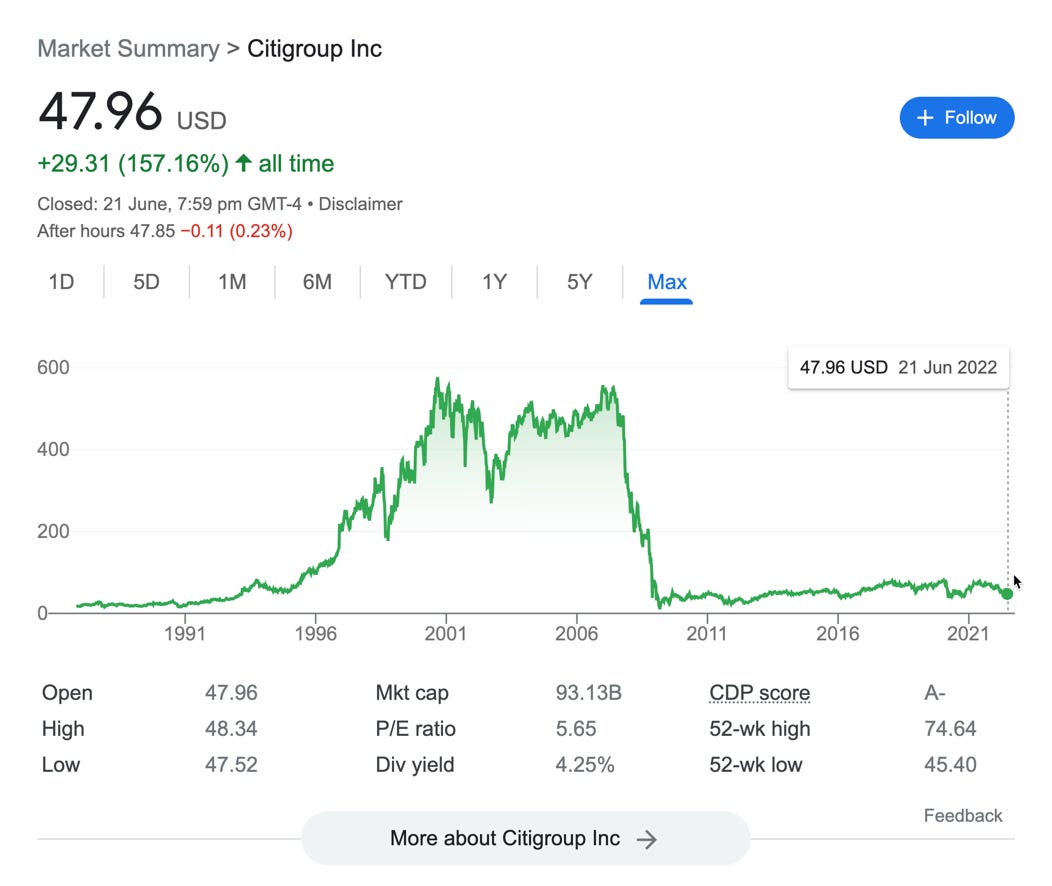

Many, not all, financial services institutions are established players who have enjoyed the largesse of high profits for extended periods. But it’s a different story when it comes to shareholder returns. Sure, dividends have been great for some. But share price growth has stagnated.

Take Citigroup for example. A massive financial services powerhouse with over 220,000 employees globally, that generated $19bn in revenues in the March, 2022 quarter.

On the face of it, you’d think that Citigroup, as a flagship of the face of successful financial services institutions, would be sitting pretty. The reality is a lot different.

Year on year net profit margin is down by 40%.

Its share price has tanked since the 2008 global financial crisis, struggling to get above $80 USD compared to its halcyon days of being a $500+ priced stock.

Source: Google

Now this post is not intended to be a detailed critique of Citigroup or the industry wide financial performance obstacles of today's world. I’m a digital guy after all.

But I can read a balance sheet and an income statement (I originally studied accounting). So when I look through the regular stream of financial results that feature in the media, it’s pretty obvious something isn’t right. You don’t need a university degree in accounting or a CPA certificate to see that.

A headline that easily captures the problem that financial services is facing - courtesy of the bright minds at McKinsey and Company is this:

Industry ROE (Return on Equity) in 2020 was 6.7 percent. Less than the cost of equity.

In other words, financial services shareholders are losing out and should be chasing returns elsewhere.

The hard facts, for many a financial services CEO to digest, are these:

Banks are trading at about 1.0 times book value. (The average across other industries is 3.0 times book value.)

47 percent of banks are trading for less than the equity on their books.

Why the pessimism about financial services?

As financial services has navigated the 2008 financial crisis to our recent COVID 19 pandemic, their evolution into the modern era has meant a now familiar strategy of commoditization.

What were once assumed to be services a bank would provide at no charge in a world of higher interest margins, have been rationalised in an environment where bank margins continue to remain under intense pressure.

So in this environment, what do you do?

You commoditize your services and look for ways to increase revenue and reduce costs. No surprises there, right?

Hold on a second there. Easier said than done!

Anyone reading this post, who works in financial services, will know what I’m talking about here…Financial services is probably the most highly regulated industry on the planet.

When you understand the quantum of regulation and compliance that banks must adhere to, the costs and time invested is staggering. Deloitte estimated that these costs are 60% higher than prior to the 2008 global financial crisis.

Whether it’s product design, AML, codes of practice, legislation, or executive responsibility obligations - the amount of regulation is mind bogglingly complex. Doubly so for a simple minded digital product person like me!

So the consequence of commoditization (and misaligned priorities) has been layer upon layer of regulation and compliance.

The good news in all of this? Smart folks out there are figuring technology solutions out which allow financial services institutions to manage these obligations.

But there’s a problem in all of today’s busy-ness of running financial services institutions.

There’s no room for differentiation.

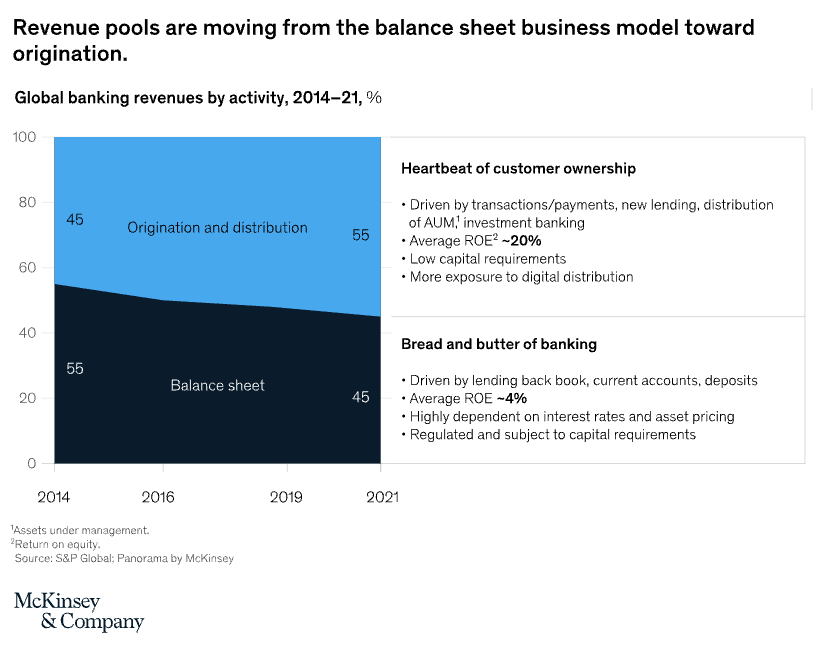

If financial services institutions are dealing with the same problems the same way, then they’re all going to end up in the same place - as McKinsey’s terms it, in “the bread and butter of banking.”

It’s this bread and butter that’s eroding shareholder returns.

When you’re fighting over customers based on interest rates, in an ocean of competition where other financial institutions are doing precisely the same, as well as commoditizing every possible service they can, this is hardly the kind of imaginative thinking that creates differentiation for customers.

Particularly when these customers are spoilt for choice in a market that’s evolving towards to specialised propositions such as Klarna (for store front BNPL), Tide (small business banking) and Venmo (peer to peer payments).

How the Winners are Winning

The winners in financial services aren’t focused on the tired playbooks of competing on margins and commoditizing every possible ounce out of their services.

They’re fighting hard in origination and distribution.

Why wouldn’t you when you can achieve 20% ROE for shareholders in origination and distribution compared to a lousy ~4% in deposits and managing lending portfolios?

Source: McKinsey & Company

What this tells us is twofold:

The business of providing deposits accounts and running lending books, whilst integral to any financial system, is tired, unattractive and heavily regulated. Anybody with half a brain would be thinking twice about entering this market and thinking they could be competitive.

Where the real ‘flow’ is at, is in helping customers do things with their money, that matter for them at a personal level. Like living. Like buying a home. Like starting and running a business. Like travelling more and working less. And the two words that ring magical in my ears here in enabling this flow are: Digital Distribution.

Digital has been the focus of my career for over 8 years now, and I’m blessed to do something I truly, truly love and enjoy. Plus it’s a highly in demand skill set. I remember making the move to digital and my boss at the time said: “Are you sure that’s a wise career move?”.

With the benefit of hindsight…hell yeah!

But it’s only in the last couple of years that the lightbulb moment has happened for senior financial services leaders who see the trend I’ve simplified above.

Understandable of course. Running a financial services institution is a demanding grind, and it’s impossible to be everywhere and across everything.

Digital intermediates a world of high regulation, of perennial commoditization, to instead double down on understanding precisely what customers want to do and creating engaging and personalized ways to accomplish this. Like I said earlier - helping customers do things with their money that matter to them.

The secret sauce in this is your ‘HOW’. How is where the Mojo is at, where the magic really happens.

The HOW, that can be emulated from the strategic patterns used successfully in big tech, which relies on:

Integrated experiences. Ecosystems. Predictive personalization. Rapid product inception to go to market cycles. Adaptive, future proofed technology.

You only have to take a look at what fintech unicons like Revolut, N26 and Starling along with Big Tech like Apple, Google and Amazon are doing to understand the potential of this new world.

Can financial services incumbents succeed (..and not go the way of dinosaurs)?

It’s going to take a massive mindshift change, at the executive and boardroom level to transform into digitally driven, customer obsessed and low cost businesses.

The kind of businesses that are less focused on outdated financial services business models, and more concerned about how to remain relevant in a $28.5 trillion global market, by truly understanding customer needs and using the same playbooks of big tech.

But let’s break this down into 3 key actionable steps that any solid digital transformation strategy should incorporate, agnostic to industry (including financial services!)

1. Use Big Tech for Inspiration

Steve Jobs was very accommodating of the idea that in order to succeed, it’s fine to copy the playbook of others, so long as you execute it better and market it well.

He drew inspiration from a visit to Xerox to create what is effectively the norm in computing today – mouse driven graphical user interfaces (GUI). Whereas Xerox were just in experimentation mode – Jobs could see the real application of what they were doing to solving real customer problems. The rest is history.

The point here is :

Big tech have solved a lot of the thinking that organizations can leverage. You don’t need to reinvent the wheel.

Instead look at ways of taking the themes that I mentioned before and adapting them for your organization to make them your own. There’s no shame in copying great ideas. 🤓

Let’s replay these themes in more detail:

Integrated experiences

If you’ve had this experience, you’ll get what I’m talking about here straight away. You call a contact centre, explain your problem (for 10 minutes) and then operator asks you to hold while they transfer you to someone else.

When you get transferred to the next representative, they have no context on your call and you start from scratch. So the amount of time you spend resolving your issue gets doubled because things just don’t connect.

Put simply - the experience isn’t integrated.

Integrated experiences are rapidly becoming the norm. This means complete functionality, not partial functionality where you have to do things manually. Or if you’re transferred to a real person from a digital experience, they have all the information they need to know who you are and what you were trying to do.Ecosystems

On a similar vein to integrated experiences, you need to consider customer journeys as a whole. Sometimes it makes sense to look at how you can solution for the entire customer journey, not just a small part of it.

An example is Google and their extensive platform of apps known presently as Google Workspace. This means that someone coming to Google to create an email account, can also set up meetings that they can then synchronise seamlessly with their calendar.

A simple example, but it demonstrates a winning mindset of knowing the next thing a customer may want to do and creating barriers to exit a product through a great experience solves the full customer journey.Predictive personalization

Amazon no longer has the exclusive monopoly on this - and that said, I find their predictive personalization capability clunky. Talking about clunky - check out my Linkedin post on Glassdoor’s broken personalization engine.

An example from a few years ago that is still paying dividends for Harley Davidson is their predictive analytics capability that targets potential customers, generate leads and close sales. When customers are targeted directly, they can have a more personalized experience that leads to higher satisfaction.

Harley Davidson uses an AI program called Albert to identify potential high-value customers ready to make a purchase and then creating a personalized and highly engaging sales experience that ensures would be owners feel like they’ve made the right choice.Rapid product inception to go to market cycles.

Let’s face it – big, old world organizations tend to suck at this.

They implement agile and forget to rewire their mindset from being project driven to product driven. They effectively run ‘wagile’ – with the ‘w’ representing waterfall (as in waterfall methodology). This means they’re agile only in perception and self inflated marketing.

In reality they stick with big, clunky and often very late releases of their product, that are often so out of touch with customer needs that it ends up being a complete failure.

Instead, the smarter organizations know that they must be fast and clever when it comes to shipping products (not projects). They do this in small, bitesize increments, often daily (sometimes even hourly…although the value in this is debatable) that get what customers want into their hands rapidly.

Powerful analytics are run to determine adoption and utilisation, and guide the product backlog.

The end result?

Sharper, more value driven delivery teams who have their finger on the pulse of what excites customers.Adaptive, future proofed technology.

When it comes to extensible technology, the cost can scare most CIOs and CTOs to the point they don’t even bother putting a proposal in front of their ExCo for the need to get off old, costly and inefficient platforms that they’ve been using for decades.

The can gets kicked along the road. Despite the increasing pain of delivering anything meaningful for customers, quickly, the conversation about stepping into the modern world of adaptive, scalable and easy deployable technology is avoided.

Unfortunately, the problem doesn’t go away. It gets worse. Particularly when you see competitors who bit the bullet years earlier, who suffered the inevitable pain, and are now in the ‘flow’ of being able to scale new products rapidly using technology that provides the very best customer value.

2. Customer Led + Technology Enabled

It’s tempting to follow the industry buzzwords and get excited by the latest technology trends.

Metaverse and Web 3.0 spring to mind. But I’m sure you’ve also seen a lot on blockchain, quantum computing and edge computing.

I’ll be blunt here. Technology is useless unless it’s solving a real problem. It’s kind of like giving a Ferrari to a 70-year granny. It’s unlikely she’s going to be able to drive the car, let alone find a practical use for it. Uber would be far more suitable.

I touched on the concept of re-imagining and re-engineering at the start of this post. But it’s vital that when it comes to digital transformation you aren’t just digitising processes and applying automation, to obtain perceived cost reductions.

Instead, the frame of mind that should be approached here is all about solving customer problems first and foremost and thinking of digitalisation and automation as one tool that you can you use in your digital transformation toolkit. Talking about toolkits…

3. Toolkit Mindset

When you watch a tradesperson at work, such as a carpenter or a plumber, you’ll notice two things. They generally come in a van full of tools and equipment. Secondly, they’re proficient in how they use these tools and equipment to solve a variety of problems (well hopefully, otherwise you could be in for a disaster ahead!).

The same goes for a digital transformation in any organization. Not only do you want highly capable people who know what they are doing. You also want them thinking big picture in the range of tools and equipment they apply to creating customer value.

The adage that ‘everything looks like a nail to a carpenter’ should never apply in digital transformation.

You want people who can think about multiple ways they can solve customer problems and not just stick to one dimensional approaches.

Experience really counts here. People that have worked in digital transformations where they’ve had to use a variety of technologies to solve customer problems are worth their weight in gold. It could be cloud, it could be mobile, it could be augmented reality.

Irrespective of what it is, these people know that customer problems are never simple. They require require a diversity of skills and approaches to solving them to maximize customer value.

Digital transformation practitioners tend to excel, and are more highly valued, where they can identify opportunities to apply multiple technologies in unified architectures that can solve complete journeys.⚡️

Now you’ve completed the hard part (i.e. the learning!) now it’s time to go and complete a short exam at Skillsvarsity to get your learning badge for this micro lesson!

🦸🏻♂️ Here’s the link for the microlesson page: (skillsvarsity.com/lessons-from-digital-transformation-in-financial-services/06-2022/)

The best part about it is > it’s free <. You get this digital badge for free from Skillsvarsity for reading (and hopefully subscribing!) to this newsletter and completing a 10 minute exam. Why not get the recognition you deserve for investing in yourself and spending time studying micro lessons via my newsletter?

You can then share your recognised Skillsvarsity learning badge on Linkedin and through all your professional networks.

Okay…time for the answer to that question that I threw your way at the start of today’s post.

When was the first robot created?

You may have been thinking 19th century and Industrial revolution, or even Karakuri puppets - traditional Japanese mechanized puppets created by Japanese craftsman Hisashige Tanaka.

But it was a bit later than that. The first digitally operated robot was created in 1954 by George Devol and was called the Unimate. It was purchased by General Motors in 1959 and installed at their plant in Trenton, New Jersey to shift hot pieces of metal from a die casting machine and stack them.

Robots have come a long way since then…and I’ll be exploring them in a lot of detail on Digital X School. Make sure to subscribe!

Mata ne ! またね. (See you).

Rian Chapman is a Senior Product Manager, leading talented digital specialists crafting awesome digital products, writing exclusively at Digital X School and teaching online digital related courses.

Udemy: udemy.com/user/rob-2292

Digital X School Twitter: twitter.com/DigitalXSchool

Digital X School Linkedin: linkedin.com/company/digital-x-school

Rian Chapman Linkedin: linkedin.com/in/rianchapman